Budgeting.

Not many statements cause as much dread in business or IT leaders as “It’s time to review your budget for next year”. Budgets within any enterprise, but especially in the larger ones, are complex and difficult. In our studies and work with Lean Agile Budgeting (LAB) we have learned that the average company spends about 30% of its yearly budget simply to manage its budget. (Many CFO and financial people feel that this number may actually be higher). Why is this? Why do we put so much emphasis on something that is almost always (if we are honest) wrong?

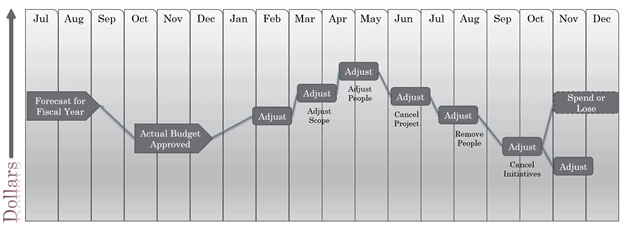

The yearly budget cycle typically looks like this:

We spend so much time creating a budget, usually in the June-August time frame (for fiscal and calendar year sync companies). And yet invariably when we start to implement on these budgets they turn out to be wrong. This leads to endless change management, budget reviews, and many slapped wrists for being wrong.

The problem is that we have based our budget cycles on predicting the future, and we as humans are terrible at predicting the future. Our crystal ball is broken, and never really worked well in the first place. When we base a yearly budget cycle on predicting we throw away the advantage that we all have; the ability to adjust based on new information.

Forecasting is a common practice in traditional budgeting, however, the term Forecast should not be used as a predictive tool, but as a learning tool. We create forecasts to do ‘what-if scenarios, to learn about opportunities, and to better prepare for unknown outcomes.

When it comes to creating budgets the key is to create a forecast that allows us to learn and plan based on what we know today but also anticipates pivots and adjustments as we gain more knowledge during the actual implementation. The key is to create a disciplined approach that allows for fast, non-disruptive adjustments. This is the heart and soul of Lean-Agile Budgeting (LAB).

But how can this be done in today’s traditional, detail-oriented, regulated, and controlled budgeting approach? With incremental changes. I have worked with several companies that have begun this journey, and the key that has emerged is to treat your current budgeting process as a tangled ball of yarn.

To be successful you cannot just cut the ball of yarn in half, instead, you have to start pulling on one string at a time. This allows you to learn in relative safety how to progress towards a budgeting process based on Lean and Agile principles and practices. Implementing practices such as Weighted Shortest Job First (WSJF) for prioritization or Participatory Budgeting to gain more information on how to distribute the budget will begin to untangle that ball of yarn.

Imagine being able to streamline your budgeting process using Lean and Agile principles and practices to reduce this budget managing cost. What better outcomes could you create for your customers and stakeholders? What more important things could your finance group spend their time on to help the company thrive?